Welcome to The APB on APA

Your all-points bulletin for mastering the mechanics of psychology.

The APB on APA is where we break down the often overwhelming world of the American Psychological Association; from the styling to the ethical code, we make it something clearer and more practical.

Here, you'll find:

Cheat sheets and hacks to save you hours on formatting and citations.

Step-by-step tutorials for everything from APA-style tables to ethical dilemma writeups.

Quick guides to updates in APA policies, publications, or best practices.

And the occasional callout or commentary when APA makes moves worth questioning.

Whether you're a student drowning in your first lit review or a seasoned pro who still Googles “APA comma rules,” this is your spot. Stay sharp. Stay current. Stay critical.

If your new here why not check out our article What Is APA Style, Really? (And Why Should You Care?)

Understanding Marking Rubrics: How to Decode What Your Lecturer Actually Wants

Essential guide to marking rubrics. Understand criteria like evaluation, analysis, and synthesis to meet academic standards and boost your university essay grades.

How to Build Strong Arguments in Essays and Reports: A Guide for Students

Essential guide for building strong arguments in essays. Covers thesis, PEEL, Toulmin model, and connecting theory to evidence for high grades.

Why Word Counts Matter: A Guide for Students

Discover why word counts matter in academic writing. This student-focused guide explains how limits improve clarity, structure, fairness, and learning—plus practical tips for managing word counts effectively.

How to Show Critical Thinking in Your Essays

Learn how to show critical thinking in psychology essays with this practical student guide. Discover how to analyse evidence, evaluate theories, and write balanced arguments with clear examples and tips for stronger academic writing.

Be Ready for Your First Psychology Lecture

Starting your psychology degree? Discover how to prepare for your first psychology lecture with tips on note taking, key terms, study habits, and avoiding Freshers’ Week burnout.

10 Things Every Psychology Freshman Should Know Before Uni

Starting a psychology degree? Discover 10 essential tips every psychology freshman should know before uni. Learn how to prepare for lectures, research, and student life.

Psych Tool Review: APA Style Table Creator (Pro)

Create perfect APA 7th edition tables instantly with the Simply Put Psych APA Table Creator (Pro). Includes statistical templates, smart formatting, and Word-ready export. Ideal for theses, papers, and psychology research.

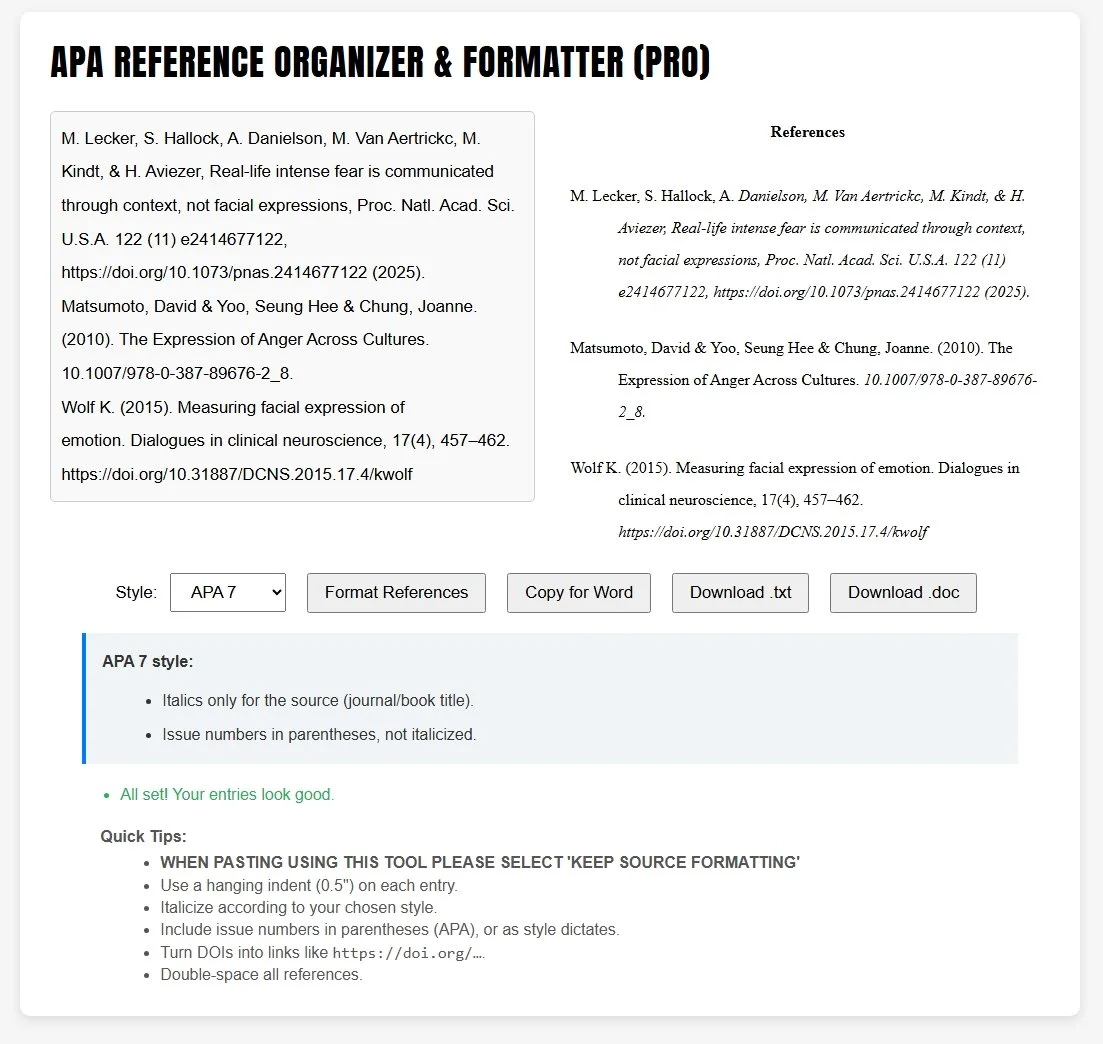

Psych Tool Review: Complete APA/MLA/Chicago Reference Formatter (Pro)

Effortlessly format APA, MLA, or Chicago references. The Simply Put Psych Reference Formatter (Pro) flags errors, previews output, and exports Word-ready citations in seconds.

Psych Tool Review: APA In-Text Citation Converter (Pro)

Generate flawless APA 7 in-text citations in seconds. The APA In-Text Citation Converter (Pro) by Simply Put Psych handles multiple authors, group citations, direct quotes, and more; perfect for students, researchers, and dissertations.

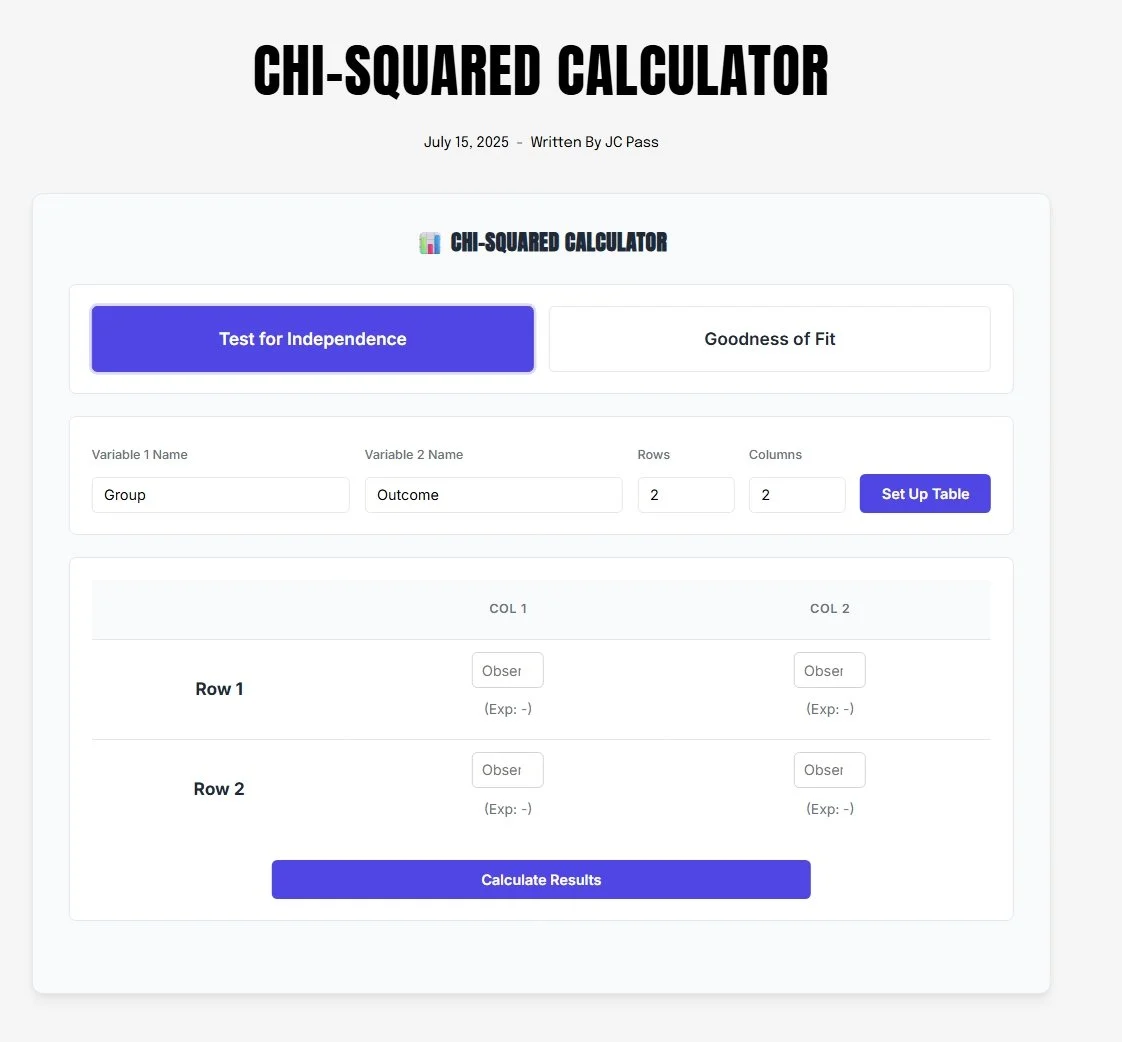

Master Your Data Analysis: Introducing the Simply Put Psych Chi-Squared Calculator

Analyze categorical data effortlessly with Simply Put Psych's Chi-Squared Calculator. Generate accurate results & APA-formatted reports for independence & goodness-of-fit tests. Essential for psychology students!

What Can You Really Do with a Psychology Degree? Exploring Career Paths Beyond Therapy

The critical thinking, research, analytical, communication, and human understanding skills you develop as a psychology student are highly valued across almost every industry. Here's a glimpse into the exciting world of psychology specializations and career opportunities beyond the traditional therapy office.

Beyond Textbooks: Prioritizing Your Mental Health in University Psychology

While focusing on your studies is important, neglecting your mental and physical well-being can quickly lead to burnout and hinder your academic performance. Prioritizing self-care isn't a luxury; it's a necessity for sustained success and a positive university experience.

How to Ace Your First Psychology Essays: Essential Tips for University Success

Starting a psychology degree is incredibly exciting, but for many new students, the thought of writing university-level essays can be daunting. Gone are the days of simple summaries; now, it's all about critical analysis, evidence-based arguments, and proper academic presentation.

How to Justify Your Sampling Method in a Psychology Assignment/Report

Master how to justify your sampling method in psychology assignments and reports. This guide covers probability vs. non-probability sampling, what markers look for, common pitfalls, and APA-compliant justification templates for stronger research design.

APA 7 Formatting Checklist & Interactive Cheatsheet

Master APA 7 formatting with this free interactive checklist and cheatsheet. Built for psychology students writing lab reports, literature reviews, dissertations, IRBs, case studies, and more. Includes Word-specific APA 7 formatting instructions.

APA Formatting in Word: A Complete Beginner's Guide to Double Spacing, Margins, Fonts, Indents, and More

Learn how to format your APA paper in Microsoft Word. Step-by-step guide on double spacing, margins, fonts, indents, page numbers, running heads, and headings for APA 7th Edition.

In-Text Citations: Parenthetical vs. Narrative Explained

Confused about APA in-text citations? Learn the difference between parenthetical and narrative citations, when to use each, and how to avoid common mistakes — in under five minutes.

What Is the APA Code of Ethics? (And Why It Actually Matters)

The APA Code of Ethics is more than a study guide — it's a real-world framework for ethical practice. Explore the five core principles and why they matter in everyday psychology.

What Is APA Style, Really? (And Why Should You Care?)

Confused about APA Style? Learn what it really is, why it matters in psychology, and how to make it work for you — without getting lost in manuals or formatting rules.

How to Format APA 7 Tables (and a Smarter Way to Do It)

Learn how to format APA 7 tables by hand, including statistical examples and formatting rules — or use a tool that does it all for you, from alignment to notes.